Money market funds allow your savings to grow by offering lower market risk!

Ak Asset Management Third Money Market Fund aims to generate revenue while maintaining partial capital preservation over the short term (two years or less) through investments in cash TL deposits and debt securities.

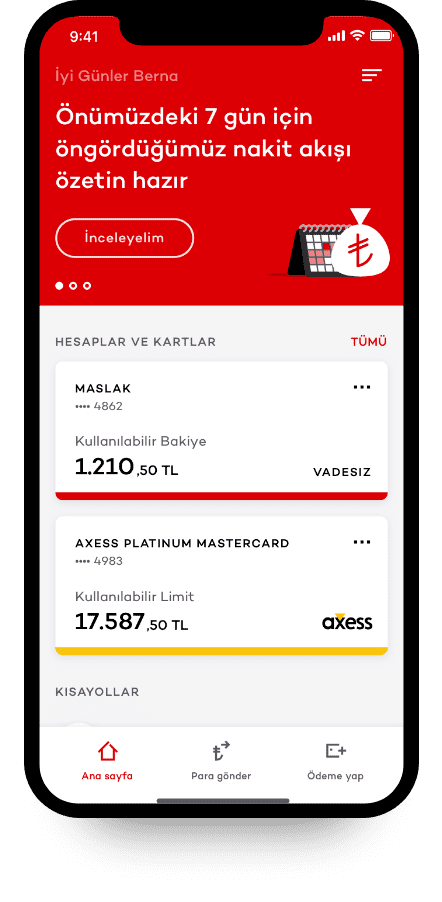

The Fund serves an access product for investing in a basket of money market products such as repo, short-term private and public sector debt instruments. Thus, it offers TL returns with minimal risk exposure. It is convertible into cash on immediate demand.

Ak Asset Management Third Money Market Fund’s assets are allocated across various instruments based on smart economic models which reflects Ak Asset Management’s in-depth experience in TL markets.