Yarının Teknolojisine Bugünden Yatırım Yapın!

Ak Portföy Robotik Teknolojiler Değişken Fonu, iş yapış şekillerini kökten değiştiren robotik ve yapay zekâ alanlarında faaliyet gösteren seçilmiş teknoloji şirketlerine yatırım yapmanızı sağlar.

Fon’un amacı, bu teknolojilerinin geliştirilmesi, üretimi, hizmet sağlayıcılığı ve bu alanlarda faaliyet gösteren şirketlere yatırım yapmaktır.

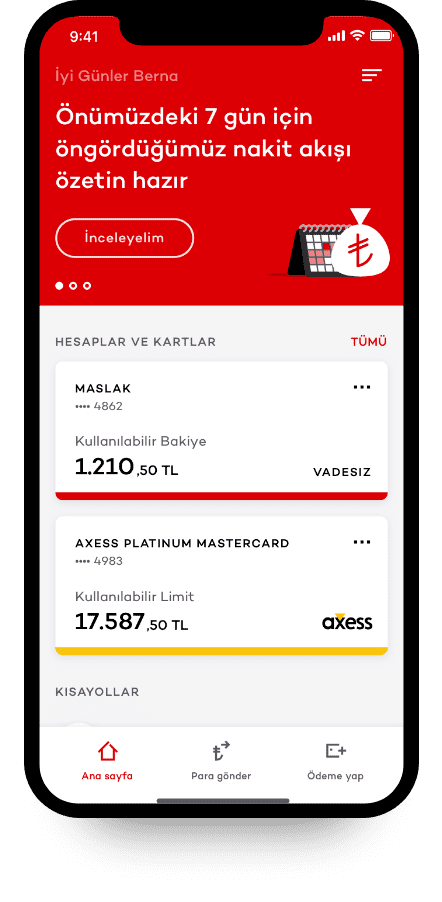

Fona yatırım yaparak robotik ve yapay zekâ alanlarında faaliyet gösteren seçilmiş şirketlerin kar payı ve borsa performansına ortak olabilirsiniz. Ayrıca bu şirketlerin ağırlıklı kısmı yabancı para cinsinden işlem gördüğü için, kurdaki değişiklikler de fon fiyatı üzerinde etkilidir.

Bu hisse senetlerine bireysel olarak yatırım yapmak maliyetli ve zahmetli bir iştir. Buna karşın fon, kendi bankanızdan tek bir işlemle sektörün önde gelen şirketlerine yatırım kolaylığı sunar.

*Fonun portföyündeki ilk 10 şirkete ait aşağıdaki dağılımlar, 28.11.2025 tarihine aittir. Ayın son iş günü itibariyle fon portföyünde yer alan tüm yatırım araçlarının dağılımına, aylık portföy dağılım raporundan erişebilirsiniz.

Produced by MSCI ESG Research as of June 30, 2025

Produced by MSCI ESG Research as of June 30, 2025