Invest in Türkiye's export power!

Ak Asset Management Exporter Companies Equity Fund offers the opportunity to invest in the shares of Türkiye's exporter companies traded on Borsa Istanbul!...

The fund provides the opportunity to invest in the growth potential and earnings of domestic companies that generate their revenues predominantly from overseas markets.

Ak Asset Management Exporter Companies Equity Fund allows you to invest approximately equally in 20 BIST-listed companies with high exports and high performance, such as Vestel, Arçelik, Şişecam and Tofaş.

The fund invests in the companies selected from the exporter companies list of Turkish Exporters’ Assembly (TIM). With this feature, it provides individual and corporate investors with the opportunity of including the theme of companies with income in foreign currency into their portfolios.

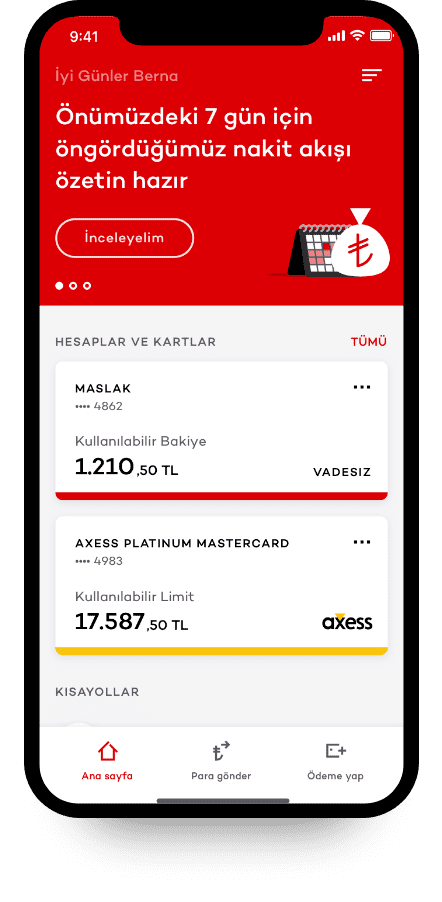

It is a demanding job to invest individually in all of these companies. In contrast, the fund offers the convenience of investing in the leading companies of the export sector a single transaction from your own bank.